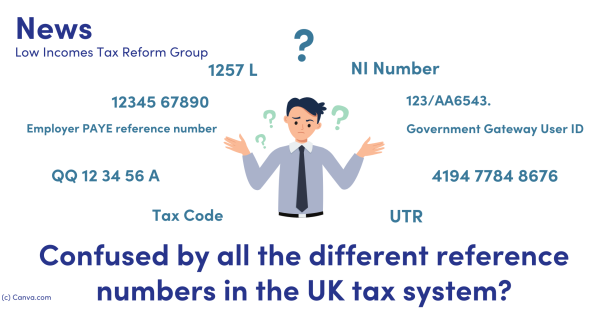

Confused By All The Different Reference Numbers In The Uk Tax System Low Incomes Tax Reform Group

Contact details for the Tax Credits Helpline and Tax Credit Office which gives information about Working Tax. How to claim Responsibility for a child Overview You can only make a claim for Child Tax Credit if you already get..

You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you cannot apply for Child Tax Credit you can apply for Universal Credit instead. To get the maximum amount of child tax credit your annual income will need to be less than 18725 in the 2023-24 tax year up from 17005 in 2022-23. If youre responsible for any children or young people born before 6 April 2017 you can get up to 3780 a year in child tax credits for your first child and up to 3235 a year for each of your other. Manage an existing benefit payment or claim Financial help if you have children Child Tax Credits if youre responsible for one child or more - how much you get. These tables show rates and allowances for tax credits Child Benefit and Guardians Allowance by tax year 6 April to 5 April..

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Ron Wyden D Ore and Rep Jason Smith R Mo said the plan includes a phased increase to the refundable portion of the child tax. The bill would incrementally increase the maximum refundable child tax credit to 1800 for 2023 tax returns 1900 for the following year and. New child tax credit for 2023 If Congress reaches a deal on the child tax credit by Jan 29 lawmakers say eligible families could benefit as. According to the framework the maximum refundable portion of Child Tax Credit would increase from the current level of 1600 per child to. The cap was previously 1600 and would increase to 1800 in 2023 1900 in 2024 and so forth Families who are eligible for this credit..

Your Child Benefit payment is usually paid early if its due on a bank holiday..

Komentar