You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. This means you will still be eligible for at least 2000 tax credit for every dependent below the age of 18 years old so long as your annual income is less than 200000 for individuals. People with kids under the age of 17 may be eligible to claim a tax credit of up to 2000 per qualifying dependent For taxes filed in 2024 1600 of the credit is potentially refundable. The Child Tax Credit Eligibility Assistant is interactive and easy to use By answering a series of questions about themselves and their family members a parent or other..

Calculate Adoption Tax Credit With Excel Template

Your personal tax account or business tax account using HMRC online services Please have your National Insurance number or Child Benefit. Up to 3905 on top of the child element For each severely disabled child Up to 1575 on top of the child element and the disabled child element To find out. HMRCs digital channel allows claimants to check claim information their tax credit payments renew their tax credits up to 31 July and also report most. You must tell HM Revenue and Customs HMRC about any change in your money work or home life if youre getting tax credits HMRC calls this a change of. You can usually be entitled to Child Benefit for a young person up to the Monday following 31 August after their 16th birthday if..

List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working. Maximum annual benefit amount Budget 2023 permanently increased the maximum annual benefit BC. The temporary top-ups end in March However Budget 2023 includes a new permanent 10 increase to the BC Family Benefit. 2024 2023 Goods and services tax harmonized sales tax GST HST credit Includes related provincial and territorial programs. ..

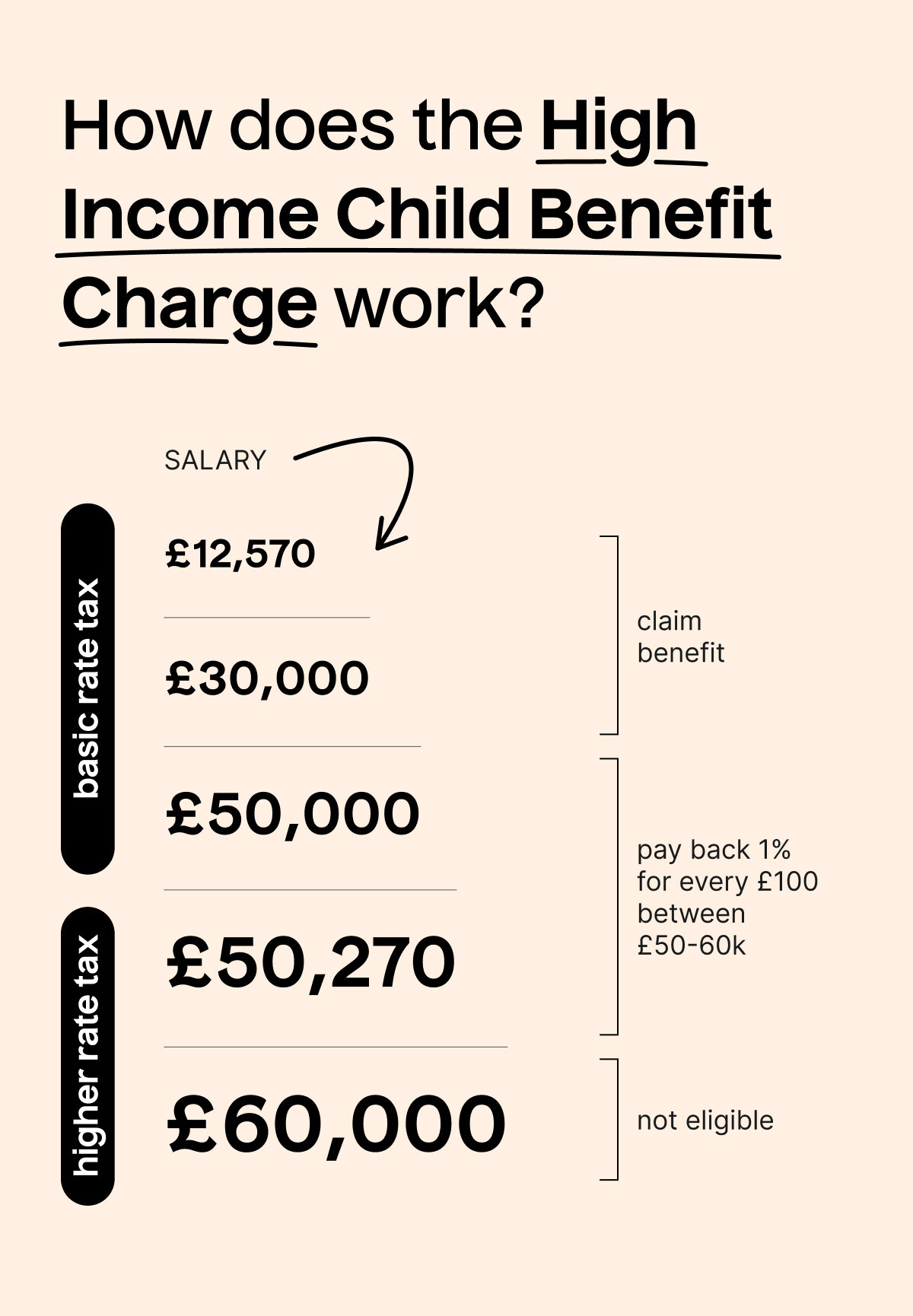

Child Benefit Tax Calculator Taxscouts

Despite its popularity the expanded tax credit expired in 2021 and in 2022 the benefit reverted to its earlier limit of 2000 per child That has had a dire impact on many low-income. According to the framework the maximum refundable portion of Child Tax Credit would increase from the current level of 1600 per child to 1800 in tax year 2023 1900 in tax year. Changes throughout 2021 such as a change in filing status change in the number of your qualifying children or a change in your income could increase or decrease the amount of. You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. For tax year 2022 the child tax credit is 2000 per child under 17 whos claimed on your tax return as a dependent Last year the credit was bumped up to 3000 per child 3600..

Komentar